Billease has introduced some significant changes and new features to enhance its services. One of these features is the Billease Limit Boost, which allows users to temporarily increase their credit limits for purchasing products like appliances, gadgets, and furniture from partner merchants. Here are the key details:

Billease has introduced some significant changes and new features to enhance its services. One of these features is the Billease Limit Boost, which allows users to temporarily increase their credit limits for purchasing products like appliances, gadgets, and furniture from partner merchants. Here are the key details:What is Billease Limit Boost?

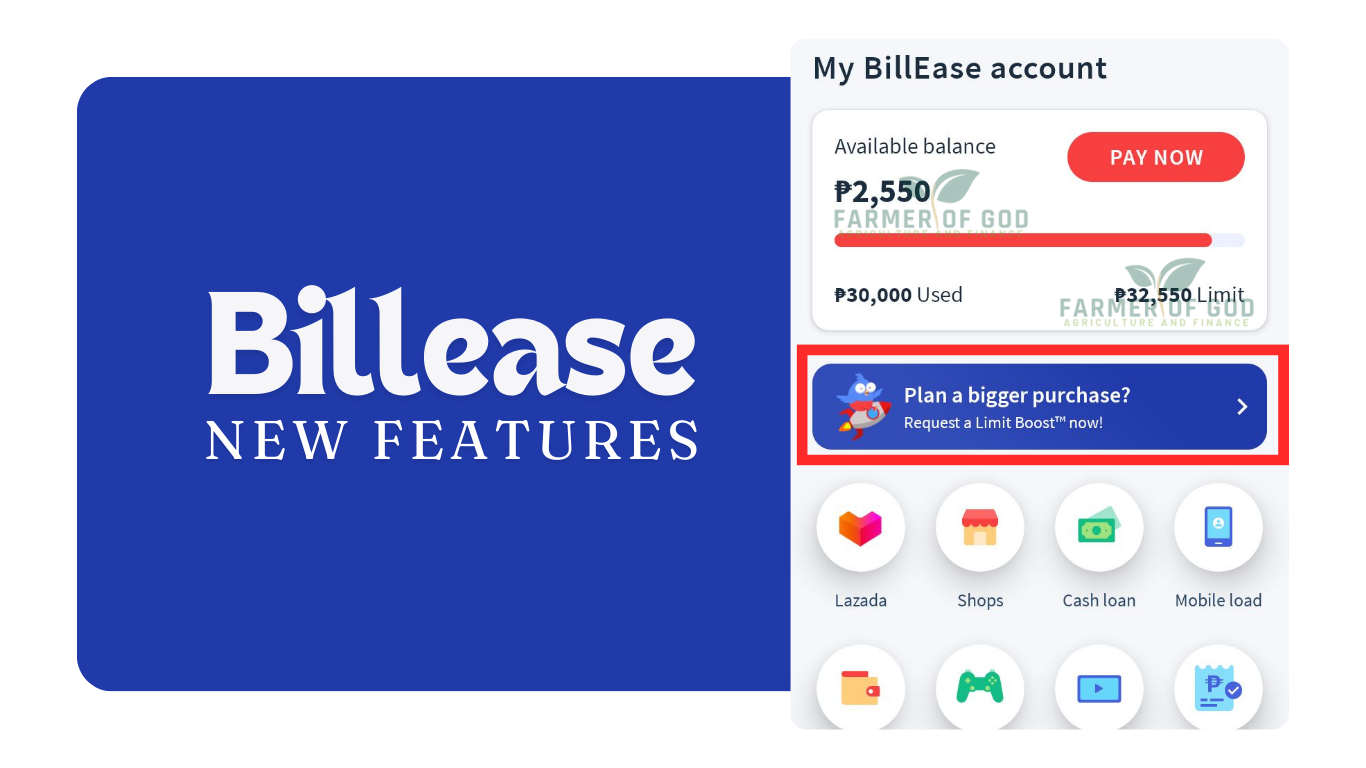

Billease Limit Boost is a feature available in the Billease App (version 4.18.0) that lets users request a temporary credit limit increase.

This boost enables users to buy products beyond their regular credit limits.

Eligibility for Limit Boost:

All users can apply for Limit Boost, but eligibility depends on factors such as credit history, bill payment behavior, and transaction history.

To improve your chances of eligibility, use Billease regularly, pay bills on time, and choose Billease as your payment method.

How to Use Billease Limit Boost:

Update your Billease App to version 4.18.0 to access the new features.

a.) Click the banner under the “Credit Limits” section in the app.

b.) Choose the merchant where you want to make a purchase.

c.) Add the amount you wish to request. Make sure it may cater the whole amount of products including shipping fees.

d.) Request the Limit Boost.

*If approved, you’ll have a limited time (3 days) to use the increased credit limit.

*You can cancel or request it again if needed.

*The Limit Boost can not convertibles to cash.

e.) Use the Limit Boost for in-store or online purchases at the chosen merchant.

Other New Feature: QR PH

Billease App now includes QR PH, allowing you to scan QR codes in stores, supermarkets, drugstores, and other establishments that accept QR payments.

Remember to explore these features and make the most of your Billease experience!

Other related Articles:

Comments

Post a Comment

Leave your comment ...