Mabilis Cash is one of the online loan apps based in the Philippines. They offer non-collateral personal loans which you can borrow money from your phone just by providing your personal information and one valid government ID. A non-collateral personal loan is an easy and fast emergency loan offered among Online Lending Apps, in the counterpart of their offers, clients will be charged a high interest rate, high processing fees, and insurance fee for their loanable amount. Mali Lending Corporation operated under the name Mabilis Cash was registered with the Security Exchange Commission on year 2019 based on the data on the SEC website. In this article let me discuss all the things you need to know about Mabilis Cash (formerly PESO AGAD). This review will be based on the experiences of users.

How much is the first offer of Mabilis Cash?

Non-collateral loans are like a stepping stone in building credit gradually. Lending Application credit assessment may depend on how you manage your loan throughout the transactions you make in their app.

Mabilis Cash can give a credit limit for first-time users from 300 Pesos to 2000 Pesos. This limit will be increasing every time you've finished your previous loan. 60,000 pesos is the maximum loanable amount that mabilis cash can offer to all clients.

Interest Rate of Mabilis Cash

Mabilis Cash adds a 1% per day interest rate to your used credits, or to simplify they charge Php300.00 for every Php1000.00 you borrow in a month. When you see their interest rate on their Application it is written like this (<0.5%/day), yes because occasionally but very rarely they offer voucher to reduce your interest rate to 50% or 0.5%/day.

For example at 1% interest rate per day, if you want to borrow Php2000.00 with 2 terms they add Php600.00 to your used credits and it will be divided into two. Your amortization will be Php1300.00/term. Take note that every term is equal to 15 days. They can offer 1 term to 4 terms for beginners. They will not charge anything nor deduct any processing fee from your owed money. Mabilis Cash will disburse your credits without any deduction directly to your registered disbursement account just within a couple of minutes but not later than 1-24 hours.

Can I get another loan even though I have a current loan in Mabilis Cash?

Mabilis Cash performs differently from other Online Lending Applications with the highest Interest rate which could increase your limit, and allow you to use your remaining Credit Limits even though you have a current unpaid loan.

Harassment in Mabilis Cash

One of my colleagues experienced that her friend received calls from anonymous numbers, the call was a follow-up of payment when he was overdue. A customer service representative of Mabilis Cash contacted some of the numbers in your contact list as they said that the borrower gave their number as contact references even not. However, Mabilis Cash never texts any harassment messages like other lending apps. This happened when the Mali Lending Corporation operated under Peso Agad but after they changed their service Mabilis Cash is seemly smooth to be a good trusted app. Let us know if you have experienced some, just comment on this article.

Is Mabilis Cash App is Secure?

Hmmm... We can not yes and we cannot say no. Let us analyze together how Mabilis Cash runs to our cell phones. Mabilis Cash asking for your confirmation to have them access your SMS, Contacts, Calendar, Phone and Notification which you hand over the tab to allow them will be your choice but if you do not allow them to access on the permission they asking for, you are possible to be rejected on your loan application. Think twice before hoarding your personal information.

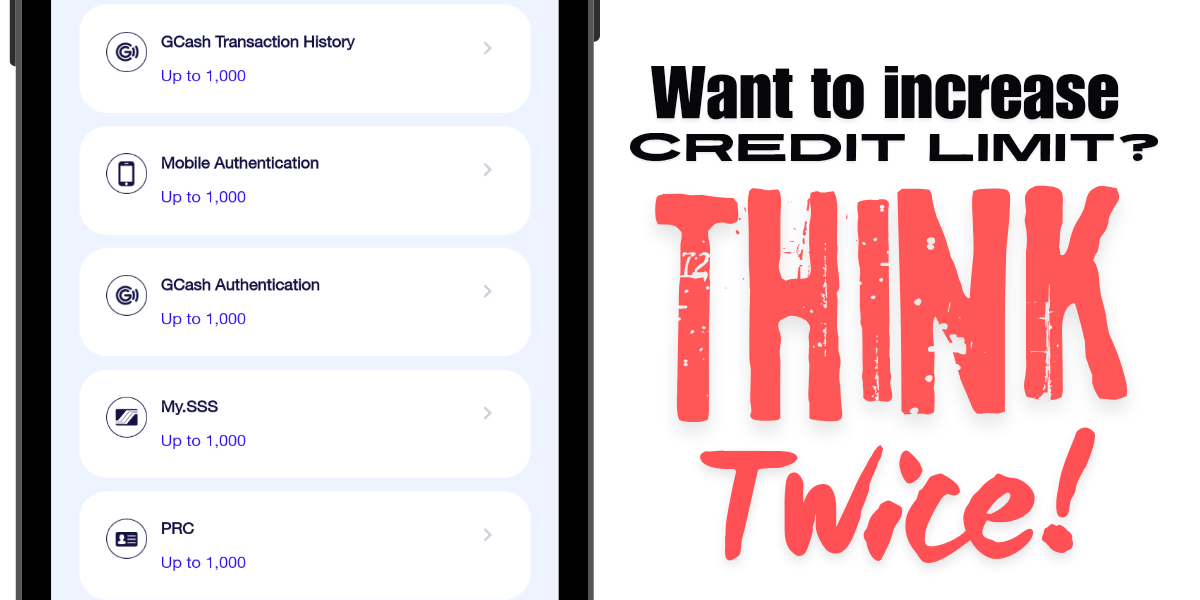

In June 2024, Mabilis Cash added a feature to their application where you can increase your credit limit by summiting additional information. One of which is Telco Verification where you will verify your mobile number upon giving your OTP to Mabilis Cash sent by Telco itself. In this case, your hand over your phone is always your choice for your security will be compromised. However, I am not saying that this will be a security threat. Just being a vigilante.

We may suggest building your credit to this application by being a good payer is enough, do not rush your credit limit to be increased.

If you are not happy with the service of Mabilis Cash or you felt unsafe they have tab for account deletion which you can navigate within your profile section. Some online Lending apps have no tab or section for deleting account. Sometimes some of the Lending apps even you will email them for account cancellation, they never taken an immediate action for your concerns.

Apply Emergency Loan Now!

Comments

Post a Comment

Leave your comment ...